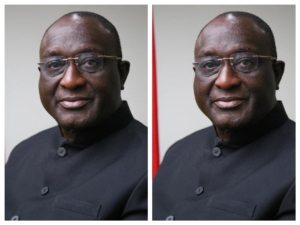

Filmore Brown purchased his Brooklyn home in 1996 and paid off the mortgage in 2019. But he could lose his property due to an unpaid water bill that he claims he was unaware of.

Per ABC7 New York, Brown became aware his home had been sold when strangers attempted to enter his property in the night. He was later left in a state of shock when he got to know the strangers’ actions were not illegal.

“I don’t want anybody to go through what I’m going through,” Brown said. “I cannot eat, I cannot drink, and I cannot sleep.”

Brown’s home was sold because he failed to pay a $5,000 water bill. But he said he had no idea about that debt.

“I didn’t know, I just would’ve paid it,” said Brown.

People who owe huge tax or water bills face repercussions from the city. Authorities put those unpaid bills on sale, and they can be purchased through a trust or by an investment group. The investors who purchase those unpaid bills can decide to recoup those funds with interest. The home can be subsequently foreclosed and auctioned if the debt is not settled.

“It was stolen from me,” Brown said in reference to his predicament.

READ ALSO: Black couple’s home was valued $500K higher after they had a White friend pose as the homeowner

And though New York City’s Department of Finance claims that it sent many notices of caution to Brown, he said he never received them. Court documents state that in November 2020, and at the peak of the COVID-19 pandemic, an individual at Brown’s home received papers regarding his property being foreclosed.

But Brown said he never received those papers. Brown resides on the last floor of his three-unit home, and the lower floors are occupied by his tenants.

“He said he didn’t know anything about this and I believe him,” Brown’s attorney, Alice Nicholson, said.

After his bill was put into the trust, Brown is said to have paid current taxes and water bills amounting to thousands of dollars, per ABC7 New York.

“He just paid a water bill this year in the thousands of dollars, so it’s just heart wrenching,” Nicholson said, adding that his present bills did not have any records of those payments after his previous bill was placed in the trust. There’s no link between those two payment systems.

“There needs to be some type of notification that there’s another bill out there that needs to be paid,” Nicholson said. “There needs to be more done to make sure that these hardworking older people who paid off their mortgage and have fixed incomes don’t get into that kind of rut.”

Per ABC7 New York, over 6,800 properties are in a trust due to unpaid water bills. Most of those debtors reside in neighborhoods of color.

“Our goal is never to see a homeowner lose their property. Last year, we implemented reforms to specifically prevent unfortunate situations like this from happening, by giving property owners more time, information, and resources to resolve their debts. For this year’s lien sale, we strengthened our outreach efforts to make sure we reached as many owners as possible, working with non-profit groups and other City agencies to conduct door-to-door visits, direct phone calls, and other targeted communications,” a spokesperson with the city’s Department of Finance said in reference to Brown’s issue.

“Homeowners have several options for resolving their debt with the City, whether it’s related to property taxes, water and sewer charges, or other municipal charges. This includes property tax exemptions for eligible residents, flexible payment plans, and other forms of assistance. Our priority is to connect property owners with these resources early, so they can protect their homes and avoid the lien sale altogether.”

READ ALSO: Dallas man loses belongings after apartment management mistakenly cleared his unit