During the COVID-19 pandemic, when citizens were compelled to conduct cashless transactions, Africa’s Fintech companies rose up to the task of keeping commerce alive in the continent’s economies. Modern technology is used by these Fintech companies to provide financial services to many of Africa’s unbanked populations. Here are five of the top fintech firms operating in Africa.

After Latin America, Africa is believed to have the world’s second-fastest growing payments and banking market. In Africa, a large portion of the population lacks access to banking services. Due to the growing middle class, it is particularly well suited for fintech technology and mobile financial services.

The fintech industry’s growth across the continent has lessened the challenges of providing banking services in the region in recent years. Over 54% of business investments in the area in 2019 were largely attributed to the fintech industry, according to Techpoint Africa.

The fintech sector is growing significantly in Africa. 2018 saw a 51% increase to $195 million in African Venture Capital funding for financial companies across the continent. Branch, a mobile lending platform based in Nigeria, alone, has secured $170 million. As evidenced by the first half of 2019, the trend is only becoming stronger.

Some four leading fintech companies operating in Africa as of 2022 are highlighted in the section below. There is no specific sequence in which the list is presented;

Paga

Tayo Oviosu launched Paga in Nigeria with the goal of enabling its customers to transfer and receive money electronically. The Paga wallet allows users to pool resources from all of their wallets and bank accounts in a single location. The development of a complete mobile payment system for financial inclusiveness in Africa is one of the key contributions Paga makes as a fintech startup.

This Nigerian fintech is used by more than 12.8 million individuals and has over 20,000 agents onboard who help customers. The agents might be paid a commission each moment one of their clients purchases something. Paga, one of the largest fintech startups in Africa, has raised $34.7 million in funding.

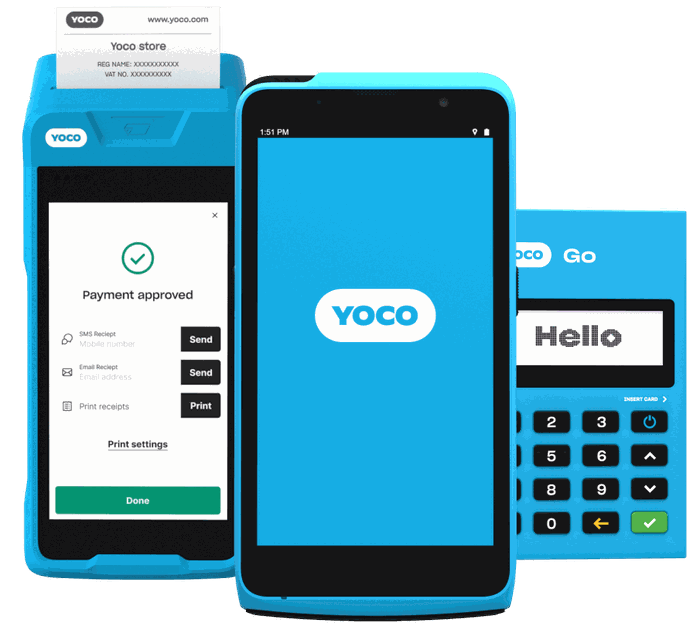

Yoco

South African-based Yoco is a fintech company that was founded in 2013. With a $83 million capital, it is one of the main fintech startups in Africa.

It is hardly surprising that Yoco, a financial company, is currently among the most valued companies on the continent. The industry still dominates startup venture capital investment in Africa, and its powerhouses attract new investors to the region.

Yoco has processed card payments totaling more than US$2 billion since its founding. Additionally, it handles payments totaling more than $1 billion USD yearly. In South Africa, Yoco is currently the digital payments network of choice for over 200 000 small and micro companies.

Palmpay

Founded in Lagos, Nigeria, in 2019, Palmpay is a top fintech business in Africa. Trassion, a Chinese producer of mobile phones, launched it, and it has since forged a unique alliance with Infinix, Techno, and Intel.

These phones already have the app pre-installed. Additionally accessible in Ghana, Palmpay has more than a million users. Peer-to-peer transactions and mobile payments are two of its offerings. Currently, Palmpay pays customers who use its payment system with cashback.

Yellow Card

With its main office in Atlanta, Georgia, the United States, Yellow Card is a Pan-African cryptocurrency trading that was founded in 2016. At the moment, it operates in 13 nations, and its market share is constantly growing.

It provides a range of cryptocurrency products and services and is dedicated to making cryptocurrencies and other banking services widely accessible to Africans. In various African nations, Africans can use Yellow Card to send cash, make payments, and protect the value of their properties from continual currency depreciation.

Africa has not been left behind in the global banking and payment system transformation brought about by financial technology (fintech). There is an anticipation of seeing fresh technologies from both established fintech businesses and up-and-coming ones.