A recent investigation has revealed that a US-based company that acquires and leases commercial jet aircraft has cheated the South African government by dodging taxes amounting to $14.8 million and there’s nothing no one can do about it.

The company, Aircastle Limited, which leases aircraft to the likes of United, American Airlines, British Airways, easyJet, KLM among others, skimmed its way and legally avoided paying taxes to the government of South Africa by routing the money to Mauritius, Quartz Africa revealed.

Mauritius is a tax haven in Africa with several companies using the small island nation to evade paying normal tax rates. The use of tax havens allows nations, businesses and wealthy individuals to pay lower rates of tax than they would in other countries by utilizing offshore tax havens.

A good method used is that companies register a business in a neighboring country with low tax rates (tax haven) and uses subsidiaries to do business with neighboring countries where their company is registered in. This way, they only pay taxes in the registered country as is the case here.

The US company is said to have made some $53 million from leasing planes to the state-owned South African airways between 2011 and 2014 alone.

Aircastle is reported to have paid just $1.5 million in tax, at an effective rate of 2.87% to Mauritius avoiding $14.8 million it would have paid to South Africa for running the business at that time.

LeCompte, executive director of faith-based anti-poverty group Jubilee USA, said in a statement. “Developing countries are losing vital monies to fight poverty and build infrastructure because of this behavior that avoids paying taxes.”

The Aircastle documents were among a trove of some 200,000 confidential records—collectively known as the Mauritius Leaks—belonging to the former Mauritius office of Bermuda-based offshore law firm Conyers Dill & Pearman, which were given to the International Consortium of Investigative Journalists (ICIJ) and shared with dozens of journalists around the world, including reporters at Quartz. The resulting investigation provides a glimpse into how foreign companies and investors have been able to take advantage of the former French colony’s tax code to profit at the expense of African nations.

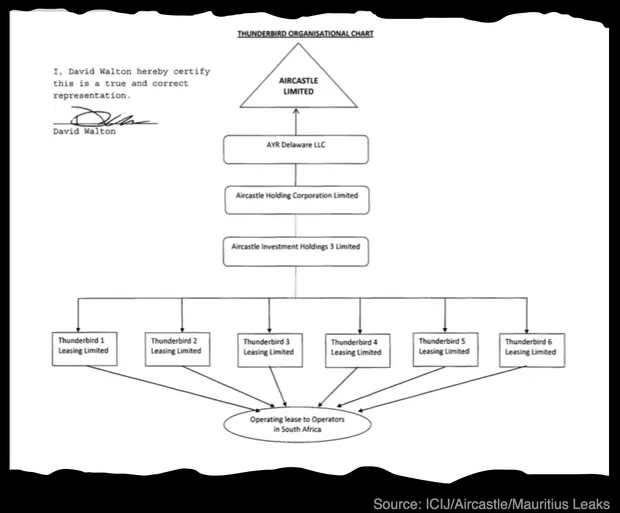

Just like several other companies and individuals that use tax havens, “Aircastle set up six Mauritian shell companies—Thunderbirds 1, 2, 3, 4, 5, and 6—and, through those, leased at least four planes to South African Airways. Each shell’s sole purpose was to collect rent on an aircraft. All six Thunderbirds were subsidiaries of various other Aircastle companies, in a chain that snaked from Mauritius through fellow tax havens Bermuda and Delaware, until reaching the publicly traded parent company Aircastle Limited,” Quartz reported.

Several confidential Aircastle bank statements show South African Airways paid its fees directly into Aircastle’s Mauritian account with Deutsche Bank, though it’s not clear whether the airline knew the account’s location.

SA Airways told ICIJ it currently pays into a Citibank account in New York for its four planes leased from Aircastle. The airline didn’t answer a question about past payments to the Mauritian Deutsche Bank account.

Before now, other companies and countries among them India has listed Mauritius as a country where foreign companies evade paying taxes in India amounting to thousands of crores of rupees by using the nation as a tax haven.

Due to its tax system, Mauritius a top source of investment into Africa but the disturbing reality is that while the country strives, other African states are cheated through schemes it helps facilitate.