Black women entrepreneurs face significant challenges in securing funding for their businesses. According to Stearnsbank, Black women are three times more likely to be rejected for business loans compared to other demographics, including white business owners. This disparity highlights systemic barriers that persist despite the qualifications and achievements of many Black women founders.

Carmen Tapio, founder of North End Teleservices, Nebraska’s largest Black-owned business, experienced this firsthand. Despite having an 850 credit score and a strong business reputation, she was unable to secure a Paycheck Protection Program loan during the pandemic.

“Decisions that were made decades ago in some instances…can put real constraints on the ability of entrepreneurs of particular races from participating in the systems and the programs that are out there,” Tapio remarked during a virtual event hosted by the Federal Reserve Bank of Minneapolis, according to Black Enterprise. Her story reflects the broader challenges Black women face in accessing financial resources.

The funding gap extends beyond traditional loans. Nationwide, only 2% of venture capital funding goes to female-only founding teams. Arian Simone, CEO and founding partner of the Fearless Fund, has been vocal about this issue. Her venture capital firm focuses on supporting underresourced entrepreneurs, particularly women of color, by providing pre-seed, seed-level, and series A financing.

However, the Fearless Fund faced legal challenges when its Fearless Strivers Grant contest, which awarded $20,000 to small businesses led by women of color, was sued by the conservative-led American Alliance for Equal Rights. The lawsuit, rooted in the Supreme Court’s controversial affirmative action ruling, accused the fund of racial discrimination, leading to the program’s shutdown.

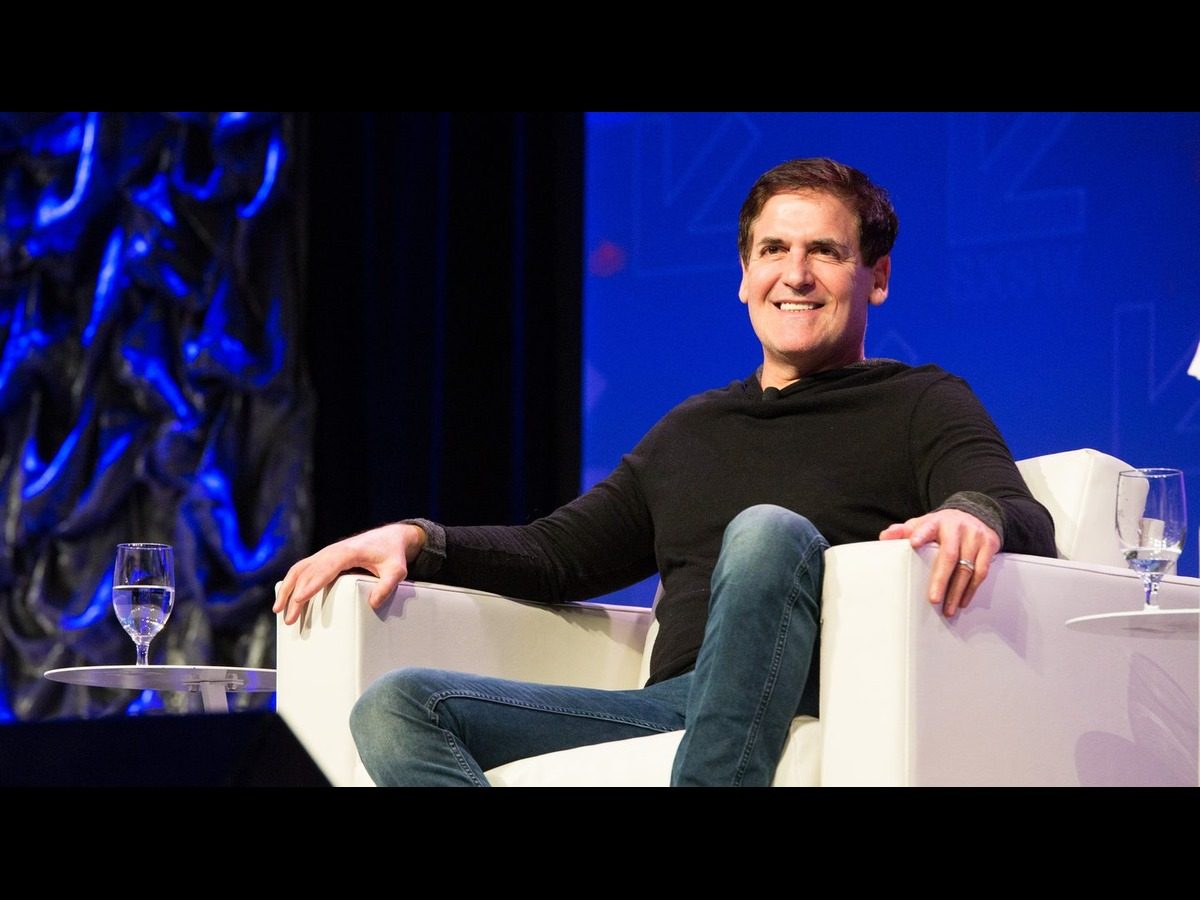

Amid these challenges, Mark Cuban, billionaire investor and Dallas Mavericks owner, offered unconventional advice to Black women founders during a panel discussion at the 2025 South by Southwest (SXSW) festival in Austin, Texas.

“I would tell you not to look for funding,” Cuban said. “You have to figure out a way to use sweat equity to build it on your own, even if it means starting smaller and slower, because there is a learning process, and it’s twofold. One is learning about your business and making it loanworthy. Then, two is learning the language of those making the loans.”

Cuban’s advice highlights the importance of self-reliance and resilience in the face of systemic barriers. However, the prevalence of predatory lending adds another layer of complexity to the financial landscape for Black women entrepreneurs.

“What’s even worse, and this is something I think is the most important point—there’s a lot of predatory lending out there, and it’s awful,” Cuban noted, as per Black Enterprise. “[The lenders] see people who may not have the financial literacy or understanding, and they’ll say, ‘Oh, yeah, I’ll make you a loan.’”

The combination of systemic discrimination, limited access to venture capital, and predatory practices creates a challenging environment for Black women founders. Yet, their determination to build successful businesses, often against the odds, continues to inspire and drive change within the entrepreneurial ecosystem.