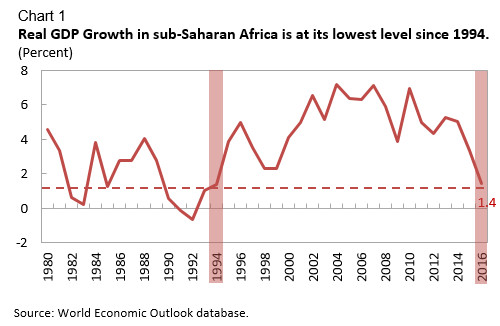

Economic growth in sub-Saharan Africa has slowed down to its lowest level in 22 years, according to a new International Monetary Fund (IMF) report titled, “World Economic and Financial Surveys: Sub-Saharan Africa Multispeed Growth.” Average growth in the region is expected to decline to 1.4 percent and GDP per capita will contract for the first time since 1994. The head of IMF’s African department, Abebe Aemro Selassie, explained that the slow economic growth is due to several factors.

“First, the external environment facing many of the region’s countries has deteriorated, notably with commodity prices at multi-year lows and financing conditions markedly tighter. Second, the policy response in many of the countries most affected by these shocks has been slow and piecemeal, raising uncertainty, deterring private investment, and stifling new sources of growth,” Selassie said.

The report notes that economic growth in the region will rise to 3 percent in 2017, but only if the countries affected address their economic policies.

Silver Lining

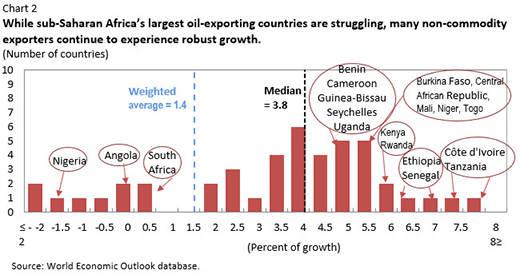

Despite the overall downward trend in the region, certain countries have been recording fast growth. Classified as “non-resource intensive countries,” these select nations are characterized as having an improved business environment, continuous infrastructure environment, and are beneficiaries of low prices for imported oil.

“These are countries that are predicted to grow at more than 6 percent. They include the Central African Republic, Cote d’Ivoire, and Ethiopia,” notes the report.

Other countries that have fared better include Kenya, Liberia, Mali, Niger, Sierra Leone, Senegal, and Tanzania.

In contrast, countries that export commodities are under severe economic pressure, including the region’s three largest countries, Angola, Nigeria, and South Africa, due to low oil prices. The Democratic Republic of Congo, Ghana, South Africa, Zambia, and Zimbabwe have also been adversely affected, according to the report. Equatorial Guinea is the only oil exporter that is an exception.

In oil exporting countries with flexible regimes, the exchange rates have been slow to adjust, putting pressure on deposits and foreign exchange reserves. This has discouraged investments and made economic growth difficult to attain.

All these factors can be attributed to a global trend of economic volatility. International trade partners, such as the United States and the United Kingdom, have also reported slowed economic growth. The decision by the United Kingdom to leave the European Union has not helped matters.

China’s recent policy to transition from a manufacturing to a services-based economy has also played a factor. For more than a decade, the Chinese relied on African commodity exporters for their raw materials.

Solutions Moving Forward

The report notes that these disadvantages can be remedied with a positive public policy response. For instance, the exchange rate can be allowed to absorb external pressures leading to macro-economic stability as well as a tightened monetary policy that discourages inflation. Another solution is fiscal consolidation for countries that have been hardest-hit by the economic downturn.

Diaspora remittances is also another solution. The report notes that fiscal revenues generated by sub-Saharan Africans who have migrated have contributed to poverty alleviation in their home countries.

The report also proposes risk management policies that can protect the region’s agriculture sector from natural disasters often caused by climate change. These policies include buffers, social safety nets, and disaster relief efforts from the international community.